Last year, activity on the betting site Polymarket exploded. Ever since, many of my friends who I understand to be vaguely interested in financial markets have written to me, touting opportunities they describe as “free money.”

Since Polymarket is not swimming with chumps, portfolios of these trades usually offer the kind of risk profile you’d realize after selling a chunk of wings: a weakly positive mean with a generous amount of (negative) skew.

That being said, some Polymarket contracts display real inefficiencies. Last week, one caught my eye: What price will Bitcoin hit by March 31? The contract struck at, say, $110k will pay out $0.13 if Bitcoin touches $110k before 3/31.

This market is interesting because it can be hedged using American options. A little work reveals that the event probabilities implied by the options do not match those listed on Polymarket, opening the door to an arbitrage.

In this post, I’ll

walk through the trade, and

show more generally that over/under Polymarket contracts tend to overprice volatility in the underlying.

Binary calls

An O/U bet is a binary (or digital) call. On Polymarket, these calls are American: If the price of the underlying is above some strike price at any time prior to expiration, the buyer of the call can exercise it for a fixed payout.

The payout of a binary call can be closely replicated using a tight call spread, as shown above. For an American binary call, if the underlying ever surpasses the strike, the holder will immediately exercise for a maximal payout.

The trade

Cool. So what is the trade? Well, the nice thing about a binary call is that it embeds implied odds. If the binary call shown in the figure above was priced at $0.5, it would be offering even odds. If the underlying surpasses the strike, you profit $0.5; if it doesn’t, you lose $0.5, the cost of the option.

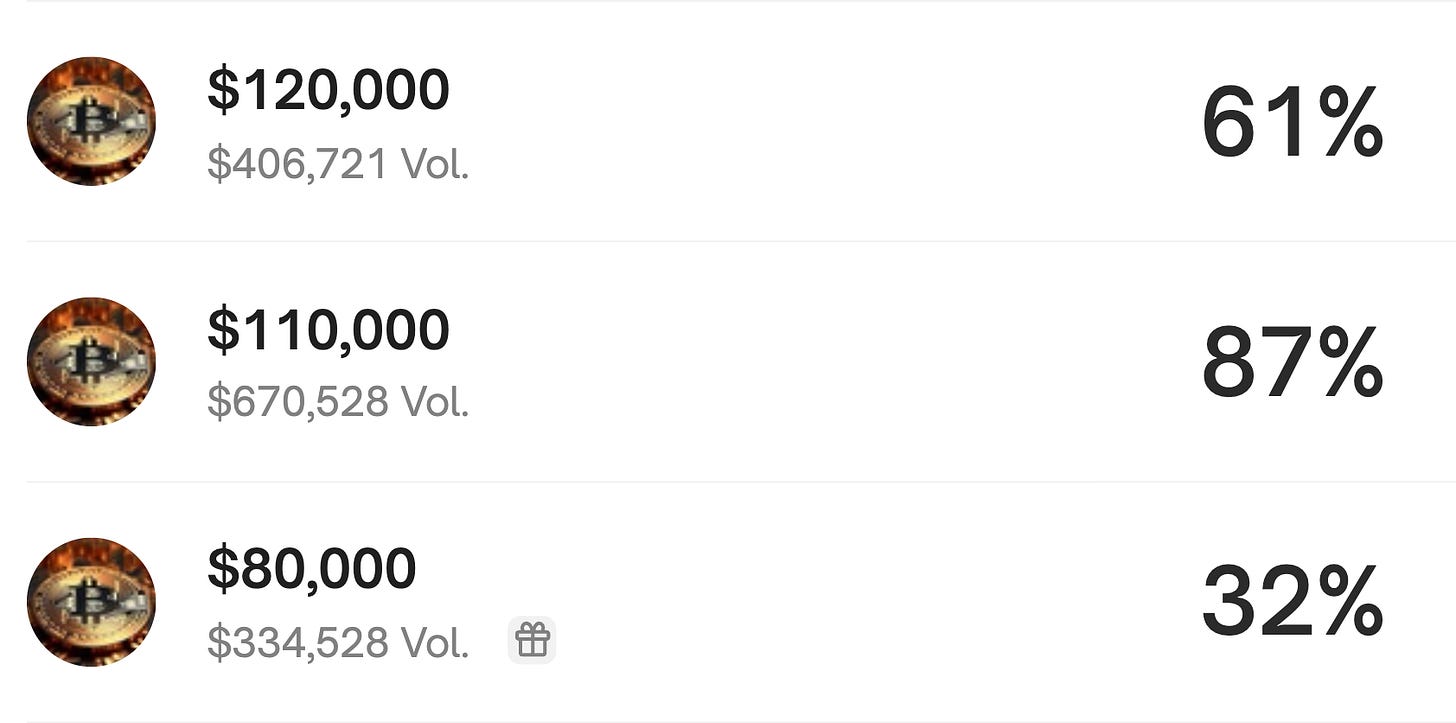

This means we can translate the prices of narrow call or put spreads into a space of option-implied probabilities, each tied to the event that Bitcoin touches some given price level before some future date. I did this using BlackRock’s IBIT ETF as the underlying, and I got the results shown below.

Nice. The Polymarket probabilities are much higher than those implied by the options, so there should be a trade here. (For the pedants: Since call spreads can’t perfectly replicate binary calls, it’s not rigorous to assert that any misalignment here implies an arbitrage. But it’s still a valuable screening tool.)

If we believe Polymarket is the more inefficient exchange, we can conclude that it is overestimating Bitcoin’s forward volatility across strikes. If you’re especially observant, you’ll note that the options I’m referencing expire a week before the Polymarket contract resolves. Don’t worry—I’ll get to that.

The details

Let’s implement this trade for the strike at $110k. Bitcoin is currently trading at $105.5k. If Bitcoin hits $110k, IBIT should trade at a little under $63.00 per share, so we’ll look at the March 62/63 call spread on IBIT.

Right now, for $71.85, we can buy 1 of these call spreads and sell 95 Polymarket calls. These quantities have been configured to ensure that we’re buying a non-negative payout function. Through this position, we’ve subtracted a step function from a call spread. This yields the P/L graph shown below.

If Bitcoin stays below $110k, this trade will return a minimum of 32.2% and a maximum of 131.0% in 2.5 months! If Bitcoin surpasses $110k, we lose on our Polymarket shorts, leaving us with a lone call spread. Assuming you don’t believe that you have edge on that spread (I know I don’t!), you’d then want to close that position out immediately, netting 0% (the minimum payout above).

Beautiful, really. We mapped some points from a space of prices to a space of probabilities, found a misalignment, and converted that misalignment into a trade that can’t lose. A textbook arbitrage can really fan your passion for markets.

The risks

Okay, okay. Put the pitchforks away—nothing is a textbook arbitrage.

One risk is that our IBIT options will expire a week before the Polymarket contract. This could be very bad, but luckily, the Polymarket probabilities are still bid above the market-implied probabilities for longer-dated options, so if you’re willing to shell out some extra dough, you can eliminate this risk.

A second practical issue for many traders (like me) is that Polymarket is banned in a lot of places. In my opinion, traders should never really entertain regulatory risk, especially when the regulations are pretty clear-cut.

One final issue is that IBIT probably doesn’t perfectly track Bitcoin’s return. Furthermore, the Polymarket contract actually references Binance’s BTC/USDT trading pair, which could cause issues with tracking.

Subscribe!

Risks aside, I hope this post brought you some joy today! If you liked it, subscribe, share, leave a comment—whatever!

One other interesting avenue you could have discussed is how the Polymarket community which is primarily crypto bulls and avid users (since you have to deposit in crypto you must know the ropes somewhat) so the Yes prices are usually inflated quite a bit over fair value making the No side +EV (although high variance as anything high vol/crypto). This positive skew is quite interesting when we typically would see some negative skew in most US equities where people pay up for insurance on the puts side. This is probably the fundamental reason this arbitrage exists.

The other thing is that if the "over" is overpriced then the "under" must be underpriced because of how binary contracts on Polymarket function. It is impossible for them to both be overpriced.

The screenshot you posted would yield a 13c profit and not 23c btw.